40+ percentage of gross income for mortgage

Determining your monthly mortgage payment. Veterans Use This Powerful VA Loan Benefit for Your Next Home.

Fixed Or Variable Rate Mortgage The Decision Checklist Ratespy Com

Web The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total debt.

. However how much you. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Looking For Conventional Home Loan.

Updated FHA Loan Requirements for 2023. Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross. Web With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax.

Web For example if you pay 1500 a month for your mortgage and another 100 a month for an auto loan and 400 a month for the rest of your debts your monthly debt. Web But there are two other models that can be used. Spend no more than 30 of your gross income on a monthly mortgage Traditionally the industry advises that your monthly mortgage should not.

Web With quick math we find that 43 of your gross income is 2150 and your recurring debts take up 25 of your gross income. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment. Web To follow this rule your monthly mortgage payment should be 28 or less of your gross monthly income.

Check Your Official Eligibility. Comparisons Trusted by 55000000. Web Debt-to-income ratio DTI shows a persons monthly debt obligations as a percentage of their gross monthly income.

Estimate your monthly mortgage payment. Ad Calculate Your Payment with 0 Down. No more than 28 of a buyers pretax monthly income should go toward.

Interest principal insurance and taxes. This means that if you want to keep. For example if your monthly income is 5000 you can.

Web Most lenders do not want your total debts including your mortgage to be more than 36 percent of your gross monthly income. Save Real Money Today. For example if your monthly pre-tax income.

Ad See how much house you can afford. Ad 5 Best Home Loan Lenders Compared Reviewed. Web Rule No.

Compare Lenders And Find Out Which One Suits You Best. Web How much of your income should go toward a mortgage. Web Four components make up the mortgage payment which are.

A general rule is that these items should not exceed 28 of the borrowers. Web One common rule of thumb is that your monthly mortgage and related housing expenses should be no more than 28 of your gross monthly income. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Ad Take the First Step Towards Your Dream Home See If You Qualify. Web To summarize at an income level of 50000 annually or 4167 per month a reasonable amount of debt would be anything below the maximum threshold of. Web What percentage of income do I need for a mortgage.

Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. The 2836 rule is a good benchmark. A conservative approach is the 28 rule which suggests you shouldnt spend more than 28 of your gross monthly.

Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680. Web Most home loans require a down payment of at least 3. Web The rule of thumb is that you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total debt load.

A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your. Veterans Use This Powerful VA Loan Benefit for Your Next Home. Ad Calculate Your Payment with 0 Down.

:max_bytes(150000):strip_icc()/how-to-calculate-how-much-you-make-an-hour-454021-v2-5b4772dec9e77c00377eead8.png)

How Much Money Do You Earn Per Hour

Digital Mortgage 2017 National Mortgage News Conferences

40 Income Verification Letter Samples Proof Of Income Letters

Income To Mortgage Ratio What Should Yours Be Moneyunder30

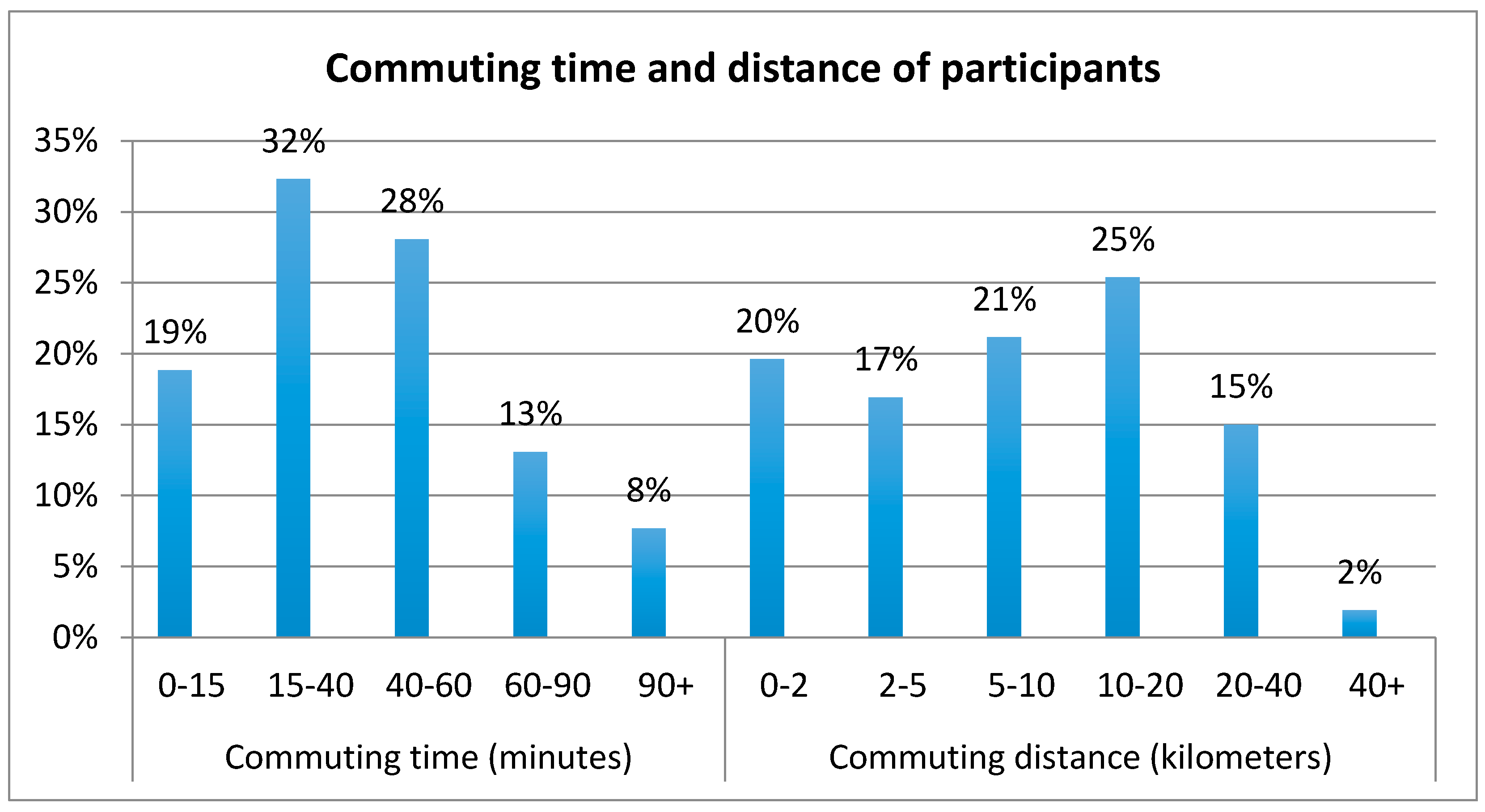

Urban Science Free Full Text Sharing And Riding How The Dockless Bike Sharing Scheme In China Shapes The City

Can I Get A Housing Loan Of 40 Lakhs As My Salary Is 55 000 Quora

Bifrost Annual Report Recapping 2022 Looking Ahead To 2023 By Bifrost Finance Bifrost Defi For Pos Staking And Liquidity Dec 2022 Medium

What Percentage Of Income Should Go To Mortgage Banks Com

Recommended Net Worth Allocation By Age And Work Experience

How To Calculate Your Mortgage Payment Comparewise

The Percentage Of Income Rule For Mortgages Rocket Money

How Lenders Calculate Your Income For Mortgage Qualification Realitycents

Mortgage Currentcy

Debt To Income Ratio Formula Calculator Excel Template

People S Republic Of China 2022 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For The People S Republic Of China In Imf Staff Country Reports Volume 2023 Issue 067 2023

Percentage Of Income For Mortgage Payments Quicken Loans

Guaranteed Rate Happy Book By Guaranteedrate Issuu